Why Is Wichita Falls So Affordable? October 2025 Market Analysis Reveals 51% Savings vs National Average

If you’re asking yourself “Where can I afford to buy a home in Texas?” or “What’s the most affordable city near Sheppard Air Force Base?” – the answer is clear. Wichita Falls continues to stand out as one of the most affordable housing markets in both Texas and the entire United States with an incredible opportunity for growth potential.

Expert Guide: Wichita Falls Real Estate Market Update | October 2025

As a retired Air Force officer who’s helped hundreds of military families navigate PCS moves in and out of North Texas, I track these numbers closely. And the October 2025 data tells a compelling story about why Wichita Falls remains the smart choice for buyers who want to maximize their housing dollars.

The Bottom Line: What You Actually Save

Let me cut right to what matters most – your wallet.

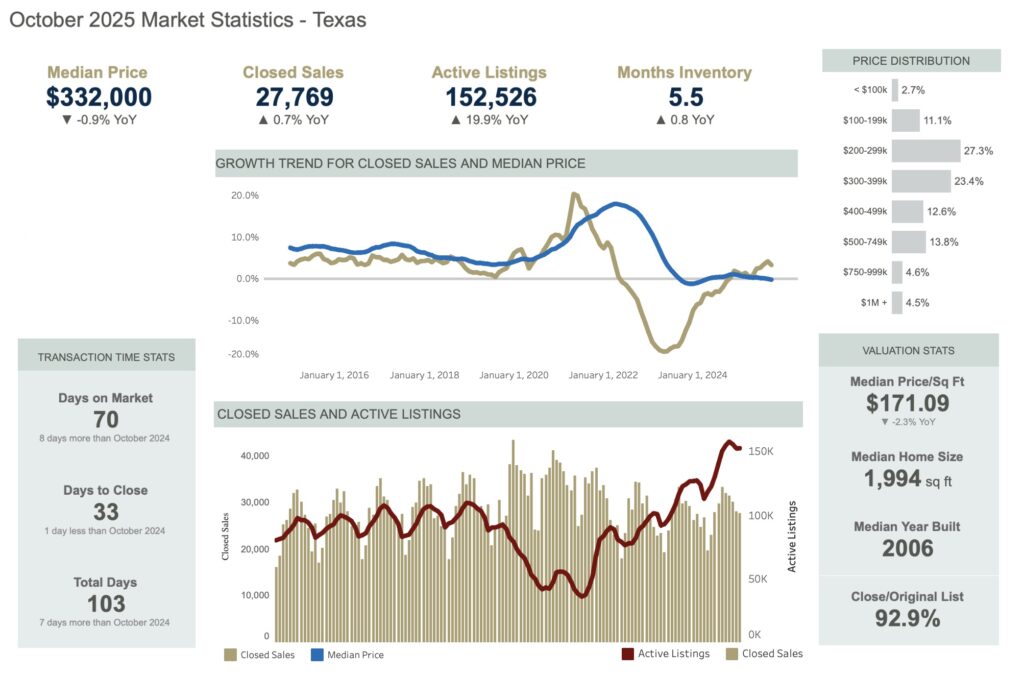

Compared to the national median home price ($416,900–$422,800), Wichita Falls homes at $206,500 cost about 51% less. That’s not a typo. You’re looking at savings of over $200,000 compared to the typical American home.

Compared to the Texas median of $332,000, Wichita Falls homes are 37.8% more affordable. That’s a $125,500 difference that stays in your pocket – money you can use for renovations, savings, or simply breathing room in your monthly budget.

Here’s how the numbers stack up:

- Wichita Falls Median Price: $206,500

- Texas Median Price: $332,000 (38% higher)

- U.S. Median Price: $416,900–$422,800 (51% higher)

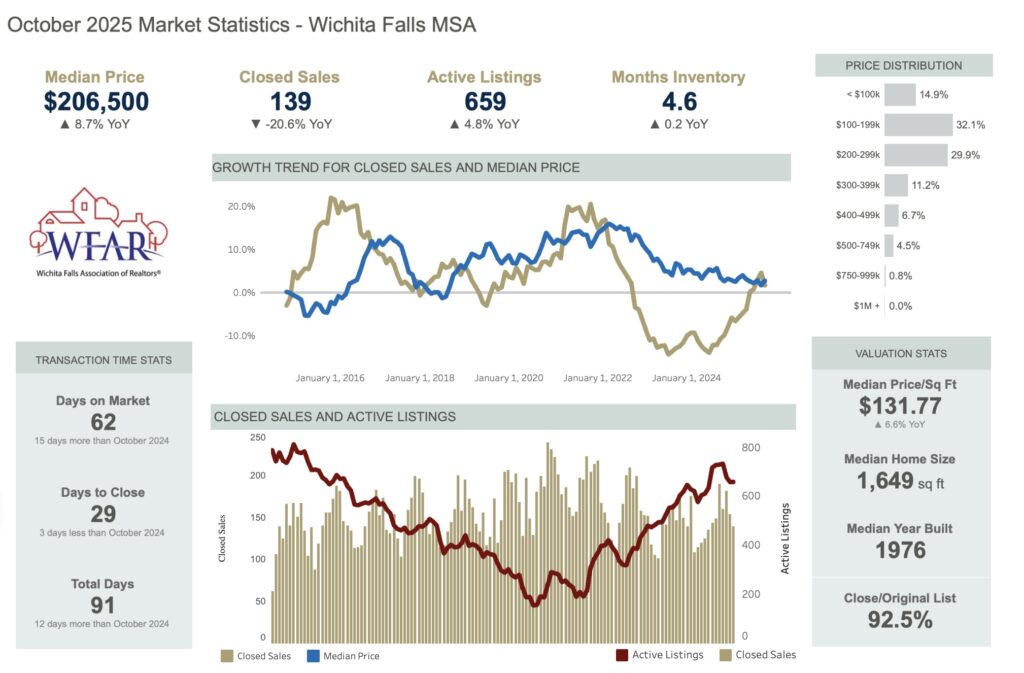

October 2025: Wichita Falls Market Performance

The latest data from the Wichita Falls Association of REALTORS® shows a market that’s active, stable, and still delivering value.

Key Metrics:

- Median Price: $206,500 (up 8.7% year-over-year and from $195,000 in September)

- Closed Sales: 139 transactions (down 20.6% from October 2024)

- Active Listings: 659 available homes (up 4.8% year-over-year)

- Months Inventory: 4.6 months (stable, up just 0.2 from October 2024)

- Days on Market: 62 days (15 days longer than October 2024)

- Median Price per Square Foot: $131.77 (up 6.6% year-over-year)

What This Means for Buyers:

The slight increase in days on market and inventory levels means you have more time to make informed decisions. This isn’t a panic market where you need to waive inspections or overbid. It’s a balanced environment where prepared buyers can negotiate effectively.

The 8.7% year-over-year price increase shows healthy appreciation without the explosive growth that makes homeownership unattainable. Your home is building equity, but you’re not priced out of the market.

Price Per Square Foot: Where Your Money Goes Further

This is where Wichita Falls really shines for military families and relocating professionals.

At $131.77 per square foot, Wichita Falls homes cost about 23% less per square foot than the Texas average of $171.09. What does that mean in real terms?

A 2,000-square-foot home in Wichita Falls costs approximately $263,540. That same home in an average Texas market would run you $342,180 – a difference of nearly $80,000.

For military families coming from high-cost areas or buyers relocating from other Texas metros, this translates to either:

- More house for the same budget

- The same house with significantly lower monthly payments

- Extra cash for the home features you actually want

The Affordability Sweet Spot: Under $200K Homes

One of the most significant advantages in Wichita Falls is the availability of homes under $200,000. According to our October 2025 data, 47% of Wichita Falls homes fall into this price range.

Compare that to just 14% statewide in Texas and only 2.7% nationally, and you start to understand why VA loan buyers and first-time purchasers can actually achieve homeownership here.

Current Price Distribution in Wichita Falls:

- Under $100K: 14.9%

- $100-199K: 32.1%

- $200-299K: 29.9%

- $300-399K: 11.2%

- $400-499K: 6.7%

- $500-749K: 4.5%

Nearly 77% of available homes are priced under $300,000 – a stark contrast to major Texas metros where that price point is increasingly rare.

Texas vs. United States: Why Texas Still Wins on Affordability

Before we even get to Wichita Falls specifically, Texas as a whole offers significant affordability advantages over the national market.

Texas homes cost 21-22% less than the U.S. median, and the state maintains a strong Housing Affordability Index compared to coastal markets and other high-growth states.

Southern states, including Texas, consistently rank among the most affordable regions for homebuyers due to:

- Lower median prices relative to income

- No state income tax (more money stays in your pocket)

- Ongoing legislative reforms to increase housing accessibility

- Land availability that prevents the supply constraints seen in other markets

This means even if you’re comparing Wichita Falls to other Texas cities, you’re already starting from a better baseline than most of the country.

What October’s Numbers Mean for Different Buyers

Active-Duty Military & PCS Families

With 659 active listings and 4.6 months of inventory, you have options. The 62-day average market time means you’re not competing in bidding wars, but homes that are priced right and show well still move within 60-90 days.

If you’re PCSing to Sheppard AFB, your VA loan goes further here than almost anywhere else in the country. The median home at $206,500 is well within reach for most military families, especially dual-income households.

Retiring Veterans & Downsizers

The market has matured since the post-COVID frenzy. Sellers who prep their homes properly and price them based on current comps are still seeing success. The 8.7% year-over-year appreciation means your home equity has grown, but the normalized pace of sales means working with an experienced agent who understands military timelines is essential.

Investors & Remote Workers

At $131.77 per square foot, Wichita Falls offers one of the best price-to-rent ratios in Texas. The ongoing growth at Sheppard AFB, the new Amazon Distribution facility, and the upcoming Data Center all point to continued demand from renters and buyers.

For remote workers escaping expensive coastal markets, you can trade a 1,200-square-foot condo for a 2,500-square-foot home with a yard – and still cut your housing costs in half.

The Bigger Picture: Why Affordability Matters Beyond the Purchase Price

Lower home prices don’t just mean a smaller mortgage payment. They create a ripple effect across your entire financial life:

Lower Property Taxes: Texas property tax rates are higher than some states, but when your home is assessed at $206,500 instead of $416,900, your annual tax bill is dramatically lower.

Lower Insurance Costs: Home insurance premiums are based partly on replacement cost and home value. A less expensive home means lower annual insurance costs.

More Financial Flexibility: The difference between a $2,800 monthly housing payment and a $1,400 payment is life-changing. That’s $1,400 per month – $16,800 per year – you can invest, save, or use for your family’s priorities.

Faster Equity Building: A smaller mortgage means more of each payment goes to principal rather than interest, helping you build equity faster.

Better Debt-to-Income Ratios: Lower housing costs improve your overall financial profile for future loans, business ventures, or investments.

Current Market Dynamics: What You Should Know

The October 2025 data shows a market in transition. The 20.6% decline in closed sales compared to October 2024 reflects what we’re seeing nationally – higher interest rates have slowed transaction volume.

But here’s what the numbers aren’t telling you:

Serious buyers are still buying. The homes that are well-presented, accurately priced, and marketed effectively are still moving. The market has simply shifted from “anything sells” to “quality wins.”

Inventory is stabilizing. The 4.8% increase in active listings year-over-year means buyers have choices again. This is healthy. It means you’re not settling for a home that’s “good enough” – you can find the home that’s actually right for your family.

Price appreciation continues. Despite the sales volume decline, median prices rose 8.7% year-over-year. This indicates sustained demand and healthy market fundamentals. Wichita Falls isn’t a declining market – it’s a maturing market.

Texas Market Context: Statewide Performance in October 2025

To fully understand Wichita Falls’ position, consider the statewide Texas numbers:

- Median Price: $332,000 (down 0.9% year-over-year)

- Closed Sales: 27,769 (up 0.7% year-over-year)

- Active Listings: 152,526 (up 19.9% year-over-year)

- Months Inventory: 5.5 months

- Days on Market: 70 days

- Median Price per Sq Ft: $171.09 (down 2.3% year-over-year)

While Texas statewide saw a slight price decline, Wichita Falls posted an 8.7% gain. This divergence suggests strong local fundamentals driven by Sheppard AFB, regional economic development, and the city’s growing reputation as an affordable alternative to expensive Texas metros.

Neighborhoods to Watch: Where Affordability Meets Quality of Life

Not all Wichita Falls neighborhoods are created equal, but the affordability advantage exists across the market.

Popular Areas for Military Families:

- Fountain Park: Established neighborhood with brick homes, pools, and easy Sheppard AFB access

- Burkburnett: Strong schools, newer construction options, military-friendly community

- Iowa Park: Smaller-town feel, excellent school district, 15-minute commute to base

- Expressway Village: Convenient location, mix of home styles and price points

For Investors:

- Homes near MSU Texas for student rentals

- Properties within 15 minutes of Sheppard AFB for military renters

- Established neighborhoods with strong rental histories

Each of these areas offers homes well below the Texas and U.S. medians while providing the quality of life features families actually want.

The Military Advantage: VA Loans in an Affordable Market

If you’re using a VA loan, Wichita Falls is one of the best markets in the country for maximizing your benefit.

With zero down payment required and the median home at $206,500, you’re looking at:

- No PMI (private mortgage insurance)

- Competitive interest rates

- Closing cost advantages

- 100% financing on a home that’s building equity

In expensive markets, VA loan limits can restrict your options. In Wichita Falls, the VA loan limit isn’t even a factor for most buyers because the median price is so far below the limit.

Looking Ahead: What to Expect in Q4 2025

Based on historical patterns and current market indicators, here’s what I expect for the remainder of 2025:

For Buyers:

- Continued stable inventory levels through the holidays

- Motivated sellers as the year-end approaches

- Opportunities for strategic negotiation, especially on homes that have been listed for 60+ days

- Interest rate environment will remain the primary factor affecting affordability, not home prices

For Sellers:

- Homes that show well and are priced competitively will still move

- Professional preparation (photos, staging, repairs) matters more than ever

- Realistic pricing based on recent comps is essential

- Winter months may see slightly longer market times, but serious buyers are always active

Why This Matters: Long-Term Wealth Building Through Homeownership

I’ve helped military families buy and sell homes across multiple PCS cycles, and here’s what I’ve learned: the best investment you can make is buying a home you can comfortably afford in a market with solid fundamentals.

Wichita Falls checks both boxes.

The affordability advantage isn’t just about today – it’s about 10, 15, or 20 years from now when your home is paid off or has substantial equity while your peers in expensive markets are still underwater with crushing mortgage payments.

This is how generational wealth is built. Not through speculation in hot markets, but through consistent, sustainable homeownership in communities with strong foundations.

The Real Talk: Is Wichita Falls Right for You?

Let me be direct – Wichita Falls isn’t for everyone.

If you need the energy of Austin, the job market of Dallas, or the entertainment options of Houston, you might not find everything you’re looking for. This is a mid-sized Texas city with a strong military presence, a tight-knit community, and a quality of life that prioritizes affordability and accessibility, short and easy commuting with less than 20-minute drive times from point-to-point over trendy restaurants and nightlife.

But if you’re:

- A military family tired of throwing away money on expensive rent

- A veteran looking to retire somewhere your pension and savings actually provide financial security

- A remote worker who can live anywhere and wants to maximize your income-to-housing-cost ratio

- A first-time buyer who’s been priced out of other markets

- An investor looking for cash flow and appreciation potential

Then Wichita Falls deserves serious consideration.

How to Take Advantage of This Market

The October 2025 data presents an opportunity window for prepared buyers.

If you’re considering a move to Wichita Falls:

- Get pre-approved with a lender who understands VA loans and military timelines. I recommend connecting with experienced local lenders who know how to navigate Sheppard AFB relocations. I work with trusted professionals who get the job done right.

- Don’t wait for the “perfect” time. Interest rates fluctuate, inventory changes, but the fundamental affordability advantage of Wichita Falls remains constant.

- Work with an agent who knows the military lifestyle. Having personally navigated multiple PCS moves, including two while deployed, I understand the unique challenges and timelines military families face.

- Focus on total cost of ownership, not just purchase price. Property taxes, insurance, maintenance, and utilities all factor into true affordability.

- Think long-term. Even if you’re stationed at Sheppard AFB for just 3-4 years, homeownership can be profitable if you’re prepared to rent the property after you PCS or sell strategically when the timing is right.

Final Thoughts: The Wichita Falls Value Proposition

The October 2025 market data reinforces what I’ve been telling clients for years: Wichita Falls offers one of the best combinations of affordability, quality of life, and investment potential in Texas – and the entire country.

At 37.8% below the Texas median and 51% below the national median, homes here provide immediate financial relief and long-term wealth-building opportunities that simply don’t exist in more expensive markets.

The 8.7% year-over-year price appreciation shows this isn’t a declining market – it’s a market where values are rising at a sustainable pace while remaining accessible to military families, first-time buyers, and working professionals.

Whether you’re PCSing to Sheppard AFB, retiring from the military, relocating for work, or looking for an investment opportunity, the numbers speak for themselves: Wichita Falls is where your housing dollars go furthest.

Ready to explore what homeownership in Wichita Falls could look like for your family?

I’m Tim Lockhart, a retired Air Force officer and Wichita Falls REALTOR® specializing in helping military families navigate PCS moves with precision and confidence. I’ve built my practice on faith-based service, disciplined strategy, and AI-powered market insights that give my clients a competitive advantage.

Whether you’re buying, selling, or just exploring your options, I provide straight answers backed by real data – no pressure, no games, just the information you need to make the best decision for your family.

Contact me today to discuss your specific situation and see how Wichita Falls’ affordability advantage could change your financial future.

About the Author: Tim Lockhart is a retired Air Force officer and leader of the Lockhart Real Estate Team in Wichita Falls, Texas. He specializes in serving military families, veterans, and relocating professionals through faith-driven service and innovative, AI-powered real estate strategies. As a RamseyTrusted advisor and Keller Williams GO Network agent, Tim combines military precision with market expertise to deliver results that matter.

Disclaimer: The information provided in this blog post is for educational purposes and represents market conditions as of October 2025. Real estate markets fluctuate, and individual circumstances vary. This content should not be considered financial, tax, or legal advice. Please consult licensed professionals for specialized guidance regarding your specific situation. All statistics are derived from the Wichita Falls Association of REALTORS®, Texas Real Estate Center, and national housing data sources.

- Photo Booth Rental Wichita Falls, TX for Meaningful Events - February 18, 2026

- What Are the Steps to Buying Your First House in the Wichita Falls TX Real Estate Market? - February 5, 2026

- Wichita Falls Real Estate: Build Wealth and Find Your Dream Home - February 4, 2026

- How Do You Prepare a Home for Sale in Wichita Falls? Staging Tips That Work - February 2, 2026

- Can Disabled Veterans Buy a Home With Additional VA Assistance? | Tim Lockhart REALTOR® Explains - January 29, 2026

- Can You Sell a Home With Tenants in Wichita Falls, TX? - January 26, 2026

- Lead Like a Navy SEAL: Unbreakable Resilience for North Texas - January 22, 2026

- Wichita Falls Housing Market: December 2025 Update - January 15, 2026

- Understanding Appraisals in Wichita Falls Real Estate - January 14, 2026

- What Is My Home Worth in Wichita Falls, TX? Find Out Before You Sell - January 13, 2026